Agriculture’s Role in Global Impact Investment

Historically there has been opportunity for impact investing in Agriculture through the developing world wherein the main objective is social impact. We are approaching impact investing in agriculture through the developed world with a resource focus.

It has been proven globally over time that standard agricultural practices have depleted environmental resources, reducing productivity and long-term viability.

I’m very motivated to reverse this. I believe that we only ever borrow the land from our children – so at Impact Ag Partners we have been working to refine operational practice to ensure it restores and nurtures the land it operates on in a measurable way. I also believe in the viability and economic return for such ventures and the value of high-quality reporting metrics and impact results.

We believe that we only ever borrow the land from future generations

The global context

The Sustainable Development Goals (SDGs) were created by leaders of 194 countries. This set of 17 goals imagines a future that would be rid of poverty and hunger, and safe from the worst effects of climate change. Most SDGs have a direct linkage to agriculture. It’s a grand plan with sufficient evidence that we can contribute.

At Impact Ag Partners, our assets focus on practices that have links to the SDGs, such as:

- Nature and biodiversity conservation

- Sustainable food production

- Industry innovation and technologies

- People care and contribution

- Social equity

- Nutritious, healthy and safe food production

The Impact

Moving forward we need to re-introduce more biodiversity in our farming systems and take a longer-term view, focus on landscape hydration, and water utilisation. By building natural capital, we build in biodiversity and rotation to become more self-sufficient and less reliant on external inputs.

By building resilient businesses, environments and societies; we pursue triple bottom line success for the longer term.

The investment proposition

At the end of the day, no other practice has a stronger link with planet preservation than agriculture, including;

- Sustainable food and fibre production

- Climate change mitigation

- Natural resource conservation

We know we are in a climate where there is an appetite for impact investment, global investors are already active in impact agriculture, and we see rich opportunities to do this well in our space.

Agriculture as an Impact investment can;

- Add resilience to a portfolio in a global downturn

- Provide a hedge against inflation

- Preserve wealth and capital over time

- Demonstrate multiple impact streams

How to invest well

Investing in an impact ag venture requires knowledge and experience including the following considerations:

- Select and purchase the assets well

- Design the Investment Case with clear impact goals and economic objectives

- Invest in the infrastructure to deliver the goals

- Operate with a partner who has experience in managing to impact goals, leading operational practice and communication with all stakeholders

- Know how to measure, monitor and report on all outcomes

We are doing this now, we have the data.

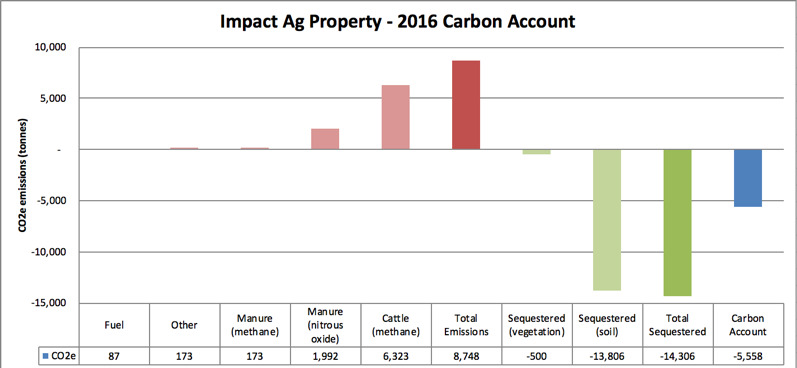

The table above demonstrates a case study for carbon accounting on one of our client’s properties.

The management objectives for an impact ag investment should be to;

- Deliver sustainable financial returns

- Build resilient balance sheets

- Improve natural assets

- Sequester soil carbon

- Reduce emissions

- Increase biodiversity

- Improve internal and external social outcomes

Technology and innovation are playing a major role in the sector, with new developments occurring rapidly. The amount of data we are able to capture today versus even a few years ago is having a huge impact on our ability to make better decisions on the ground. This leads to higher output and more resilience in the face of drought or shifting market conditions. We have seen these benefits play out in recent months in Australia where our operations sit well against others who have suffered and will continue to do so while we sustain our objectives.

The opportunity

With data and technology, advancements in environmental science and understandings of carbon behaviour; agriculture has grown up. Demand for outputs is increasing. Now is the perfect time to take advantage of agriculture as part of a balanced impact portfolio.

Learn more about what we do at www.impactag.com.au and see Bert speak on Tuesday, April 2nd at 4.45pm on the Assessing Agriculture as an Impact Investment panel as part of the Global Ag Investing: New York City 2019 Conference.

Can’t make it to the conference? Contact Bert directly

Other articles of interest:

How are institutions investing in the asset class?

How are global investors approaching agriculture?

Foreign investment in Australian agriculture.