Opportunities and Challenges Identified from #RFSIForum22

Attending our first face-to-face event since the pandemic, the Regenerative Food Systems Investment Forum in Denver was a sell-out with many from the regenerative food system and investment community attending, we were excited to be a part of it. A diverse range of sectors was in attendance with increased numbers of investors, food brands, and natural capital ag tech companies represented. It demonstrates the level of confidence and interest in the future of food and fibre production that accounts for nature resulting in an environment we are proud to pass on to future generations.

While there is still so much to achieve, it is clear this community is determined to keep the momentum. The underlying question is how and where is our capital going to be the most impactful?

Panel discussion: Investment Strategies for Regenerative Farmland – Elizabeth Candelario Mad Agriculture, Matthew Brown International Farming Co, Management, Bert Glover Impact Ag Partners, Paul McMahon SLM Partners, Justin Brunch Clear Frontier Ag.

Increasing awareness of regenerative agriculture as not only a solution to climate change but also its nutritional and human health benefits, more landholders are wanting to transition into regenerative agriculture practices.

Farmers are confronted with taking more short-term risks to the transition of regenerative practices.

Change management. Ideally, the risks of transitioning to regenerative agriculture are shared and not left to the farmers alone. More capital partners are required to take the risk with them. Changing the operations and some infrastructure on their farms, diversifying their crops, changing equipment, and finding new markets to sell their products. We need more investors and financial products to better support our farmers and farmland transition to regenerative agriculture.

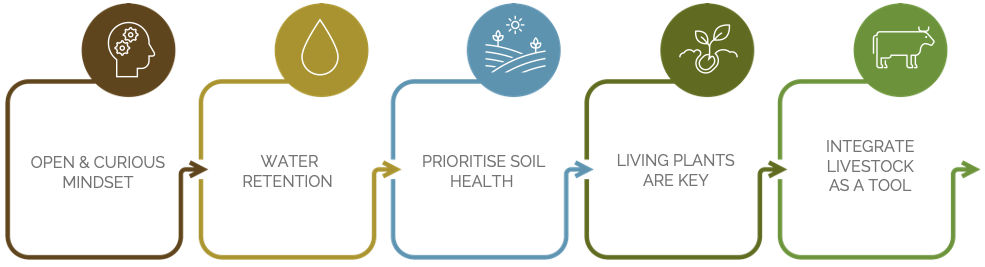

Impact Ag Partners on farm principles

Will the market pay for this? Bringing more value back to the farm gate, farmers are being rewarded for their efforts in transitioning to regenerative agriculture in the form of lower inputs and higher soil carbon sequestration. On the income side, how do they deliver the volume and scale required to support feasible supply chains and gain a premium for their product? Much more work needs to be done to build collaborative supply chain networks with robust certification, we know the market wants it we just need to collaborate.

How do you de-risk the Natural Capital components of the asset? By having “control” over the generation, management, and marketing of natural capital assets. By operating and managing the assets it ensures the generation, retention, and monetisation of natural capital. In addition, it is our duty as custodians of the land to ensure that the biodiversity and landscapes under our stewardship are continuously enhanced and improved.

At Impact Ag Partners our investments under management are using successful regenerative management practices, delivering longstanding production gains that enhance our ecosystem goals.

Change management journey with one of our investor partners, has resulted in this asset building and maintaining ecological capital during seasonally tough periods and achieving a positive total return.

Total return includes capital growth, sourced from 2021 Rural Bank Farmland Values report. • 2021 total returns include actuals to Q3 with the remaining forecast. • Waiting for 2021 soil carbon results.

We constantly collaborate with our investor partners and welcome direct input into the formulation of the strategic objectives of their allocation. We have a proven track record of generating soil carbon and improving biodiversity to build resilience. Using technology to measure ecosystem services whilst partnering to monetise natural capital where appropriate.

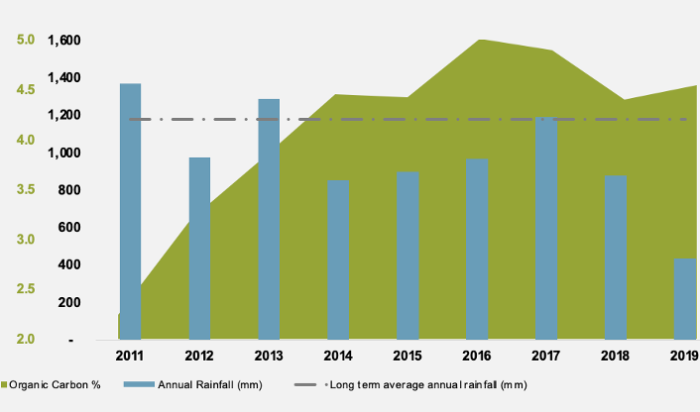

Integrating the principles of regenerative agriculture to maintain productivity while enhancing ecological health. With these practices, the asset below has sequestered carbon in higher rainfall years and successfully maintained carbon levels in lower rainfall years.

Carbon sequestering in higher rainfall years and carbon retention in lower rainfall years.

We are delivering profitable and resilient cash returns whilst growing long-term asset value.

More information on our investment partners’ successful change management journey and more case studies can be found here.