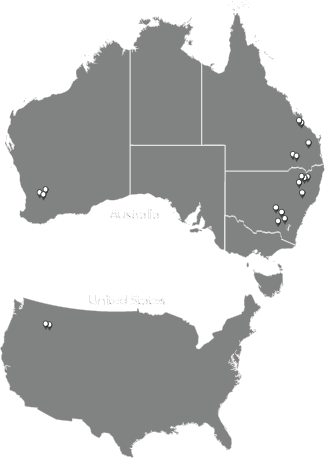

Building and preserving natural capital through regenerative agriculture for our partners across Australia and the US.

We believe agricultural investment catalyses change to address current global challenges impacting future generations

-

What we believe

-

What we do

-

How we do it

We believe that building natural capital for future generations can be done profitably.

There is an urgent need to address climate change, both in building resilience towards it’s impacts and being part of the solution.

Agriculture needs to be part of the solution towards addressing climate

change and decarbonising our economy.

We deploy capital. Formulate investment strategy, develop criteria, identify assets, conduct due diligence, and negotiate the acquisition.

We manage farms. Develop business strategies, execute leading regenerative practices, manage risk, nurture resources.

We monetise natural capital. Identify and develop pathways to increase returns – carbon markets, biodiversity offsets, green finance.

Impact Ag Partners focuses on a strategy to deliver strong economic returns whilst regenerating environmental assets and contributing to the social wealth of the community.

Natural Assets

-

500,000 acres under regenerative management across Australia & the US

-

2% increase in soil carbon sequestration

-

$1 million AUD in eco system services

Testimonials

“Bert Glover helped to rescue Cavan Station, our family property, from the results of the worst drought in living memory. From this experience in 2005/06, Bert has gone on to build Impact Ag Partners into a thoroughly professional asset management business with a wide variety of expertise. I would recommend the services of Bert and Impact Ag Partners to any prospective Investor who is looking for dynamic and innovative solutions in agricultural management”

“Bert Glover helped to rescue Cavan Station, our family property, from the results of the worst drought in living memory. From this experience in 2005/06, Bert has gone on to build Impact Ag Partners into a thoroughly professional asset management business with a wide variety of expertise. I would recommend the services of Bert and Impact Ag Partners to any prospective Investor who is looking for dynamic and innovative solutions in agricultural management”

Rupert Murdoch, Executive Chairman, NewsCorp & Owner, Cavan Station

Read the Cavan Station case study here