Impact of COP26 for agriculture and carbon prices

What does a post COP26 mean for agriculture and natural capital? While we know that regenerative farming practices nurture biodiversity, sequesters carbon, and regenerates the land and habitat, many in the industry feel little or no attention has been paid to agriculture and food at COP26 despite it being part of the solution to cutting emissions over the next few decades.

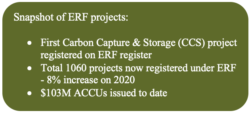

The international response to carbon prices on the back of COP26 has seen the growth in carbon market spot price is now close to AU$40/t*. The rising price reflects increased confidence in the market and more investor participation. The global carbon market is currently at $369 billion.

The general forecast for the growth of carbon prices should encourage the industry to invest in cleaner technology and industries. Technology developments for soil carbon measurement will revolutionise market participation, as recently seen by a collaboration with AACo and Food Agility (read here)

“…the industry is today in a position to significantly increase agricultural land returns whilst maintaining or enhancing primary production”, Toby Grogan Impact Ag Partners

The spot market is constrained by low availability of uncontracted supply until contracts between project developers and high emitting buyers are finalised, this constraint will continue until supply increases.

Natural Capital specialist at IAP, Toby Grogan notes, “While we are not yet able to trade internationally, with the price of ACCUs more than doubling in recent months, the opportunities for Australian agriculture are now many and varied. As we have demonstrated in carbon deals done early in the year, the industry is today in a position to significantly increase agricultural land returns whilst maintaining or enhancing primary production.”

In a recent webinar in conjunction with Regenerative Food Systems investment, industry leaders discussed post COP26 outcomes, the risks, and opportunities for agriculture in addressing climate change and participating in associated carbon and natural capital markets. One of the many points discussed was the balance between government-led action and private or business-led action for change in agriculture and natural capital. Corporates are now leading the climate change conversation and actions.

A statement from Executive Director Debbie Reed from EcoSystem Services Market Consortium who participated in the forum says, “There is real movement created in large part by the private sector joining in the conversations and making Net Zero commitments that previously were largely from Governments. The infusion of finance and commitments from corporates contributing to Natural Climate Solutions is real, and a game changer”.

You can watch the replay of the forum here.

Our approach at Impact Ag Partners is to offer investors both real assets and monetizable natural capital including carbon through agricultural generation. Read more on how we have already achieved this with our partners.

*A number of forward trades were recorded over the period, with Feb-22 (CAL 21) price rising to $40/t for the first time, while Feb-23 (CAL 22) prices remained flat at $27/t with no trades recorded since mid-September, at which point the ACCU spot price sat at around $25/t. – source Renew Economy