Agricultural investment shows resilience as an Asset Class despite COVID-19

In 2018, we reported on Agriculture as an asset class after the 2008 downturn and thought it timely to revisit as we emerge from the impacts of what COVID-19 has thrown at us.

Much like the 2008 downturn, agricultural investments were one of a few asset classes that demonstrated resilience and even growth as the real asset/infrastructure investment community looked for tangible investments.

Farmland has proven to be a reliable store of value in times of economic turmoil, including drought, fire and climate change. While financial markets and traditional asset classes have experienced volatility, the impact on Australian farmland values has been minimal.

During this pandemic, at the forefront of consumer concern, was the security of food. Supplies of food and basic commodities have remained sufficient, even with the change in behaviour of consumption and the increase in demand for reliable and safe food commodities. Supply and logistics of food were deemed as an essential industry and was not disturbed by lockdowns.

Australian Agriculture has been seen as a stable investment longer-term and COVID-19 has brought that to the spotlight even more. Agricultural land as an asset is tangible and not just another financial contract like so many other asset classes.

The lower Australian dollar and a good seasonal outlook are expected to cushion the sector from the worst effects such as drop in global demand and falling global commodity prices from impacts of reduced incomes across the world.

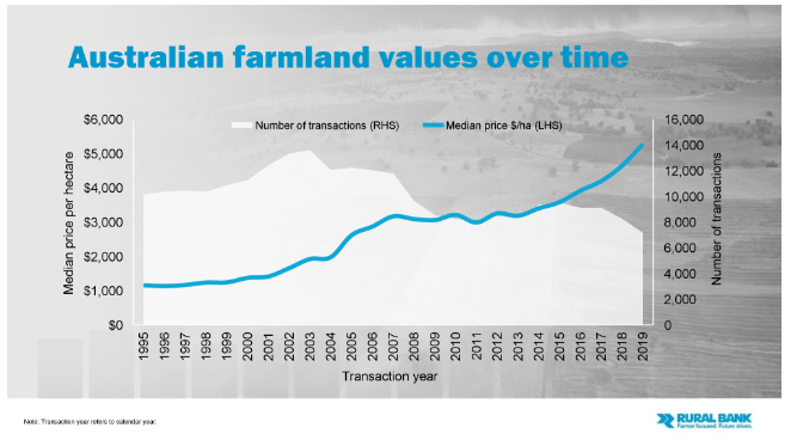

The 2020 Australian Farmland Values report from Rural Bank has stated that Australian farmland median price per hectare has increased by 13.5% in 2019, the sixth consecutive year of growth.

Some key signs of why Australian Agriculture continues to be a stable and resilient investment include:

- For over 20 years, institutional investors have altered their portfolio’s increasing allocations to real assets such as farmland.

- Historically, agriculture has been less sensitive to periods of economic reduction, both domestically and globally.

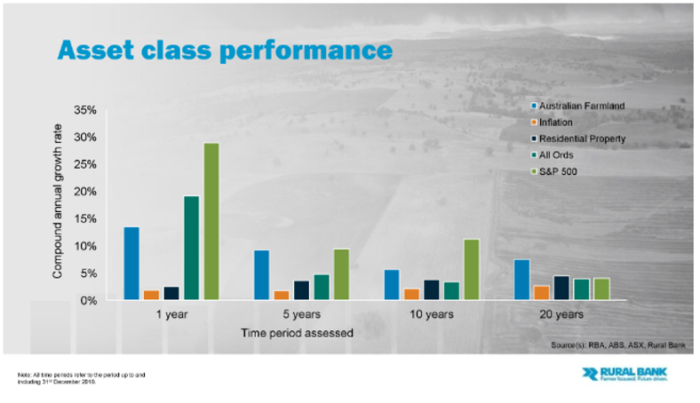

- The correlation relative to traditional asset classes, has seen Australian farmland exhibit competitive returns.

- As we see the impacts of Covid-19 disrupt global asset classes, early indications are that Agriculture is one of the few industries displaying stable economic outcomes

As we emerge from the impacts of COVID-19, Australian agriculture and farmland have remained relatively unscathed. The next six to twelve months may again prove Agriculture’s resilience in times of economic tightening as COVID-19 will continue to disrupt global economies.

This long-term trend will see farmland values continue to rise, reinforced by a strong demand for agricultural assets and increasing profitability of farming operations in an environment of low interest rates and strong commodity prices.

Read more on how we approach asset management for our clients HERE