What continues to attract investors to Australian agriculture?

Agriculture is a growing asset class amongst the investment community and generally forms part of a real asset portfolio. Today, Australian agriculture is an important solution to the global environmental challenges and by meeting future global needs, the investment can be a long-term tenable investment.

For the investor, Australian agriculture is a safe, low-risk environment with a transparent regulatory environment, along with long-term growth opportunities.

Low-Risk Investment

Australia is an attractive country in which to invest, and this is true in general of Australian agribusiness. To those abroad, it is seen as attractive as a developed, demonstrably competitive producer of agriculture products. Australian agriculture provides relatively low sovereign risk, common cultural values and institutions, opposing seasonal production systems, and globally integrated supply chains. It has a stable economic and political environment with secure ownership and title over land, is a beneficiary to free trade agreements with Japan, Korea and China and has favourable capital growth rates.

It is seen as a long term investment with well established and understood laws and government.

Investment in nature-based solutions

Investing in Agricultural real assets as a nature-based solution can respond to climate change, protect our natural resources, provide a sustainable pathway to food security and monetise natural capital. Agriculture has the potential to play a crucial role in providing financial sustainable solutions to the worlds environmental issues as it is directly related to climate.

We continue to build the momentum of more monetisation of natural capital, working with landholders, investors, and policymakers to drive NbS investment with the latest research and innovation through investment in technology and new markets.

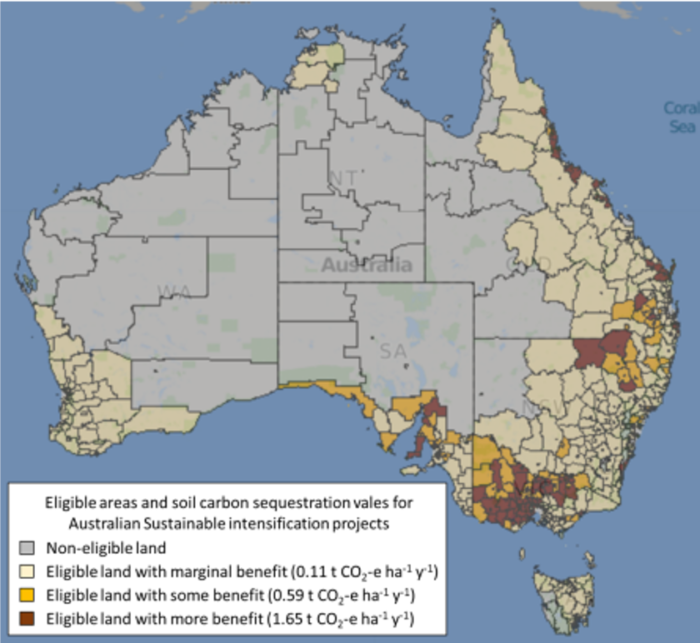

Sequestering carbon into our soils has great potential at scale to reduce atmospheric CO2 and effective address the global climate crisis. Regenerative agriculture that builds and preserves natural capital can deliver stable investment returns while improving climate resilience and storing carbon in the landscape.

Land Values

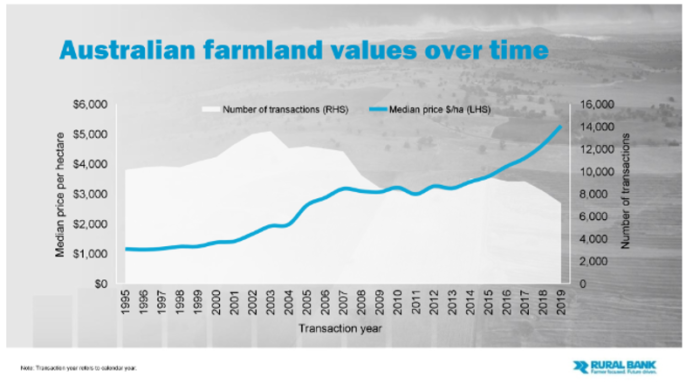

Farmland has proven to be a reliable store of value in times of economic turmoil. While financial markets and traditional asset classes have experienced volatility, the impact on Australian farmland values has been minimal.

6.9%

average annual growth

over 20 yearsSource: Rural Bank, Australian Farmland Values Report

Whilst there has been some strengthening of land values in Australia, they have not reflected global increase in values, nor have they impinged on operating profitability. Agricultural land as an asset is tangible and not just another financial contract like so many other asset classes. According to the recent Rural Bank Australian Farmland values report, the median price per hectare of Australian farmland increased by 13.5 per cent in 2019 to $5,271 per hectare. This marks the sixth consecutive year of growth, bringing the 20-year compound annual growth rate to 7.5 per cent.

Investment returns

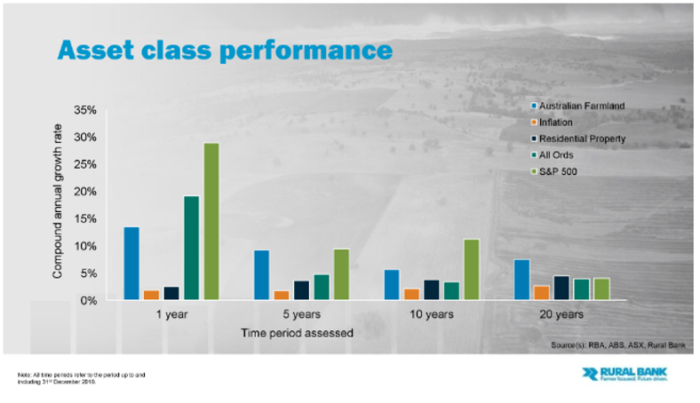

The overall investment returns from quality agricultural property in Australia have been more than comparable to those available from other major investment sectors including commercial, residential and industrial property. Importantly too, the sector has demonstrated a lower level of volatility.

Asset class with resilience

Increased market volatility has forced investors to search for assets that will be resilient. When evaluating the profitability of investment in Australian agriculture, it is appropriate to draw comparisons with returns in other sectors of Australian and global economies.

Food Security

International and domestic investors are looking to Australia as the food security solution. Investors from regions such as Asia, America and Europe have recognised Australia’s ability to produce high quality and quantities of food and fibre at globally competitive prices.

Food demand to 2050 creates vast opportunities for Australian agriculture and is in a strong position to meet this higher demand.

Institutional capital has viewed agricultural investments as part of a clearly defined real asset allocation and more recently a growing percentage starting to have an explicate allocation of funds under management.

Unique features that give Australia a competitive advantage include:

- Agricultural land is a diminishing resource

- Our production is seen as clean and green

- Competitive Australian Dollar

- Close proximity to Asian markets

- Competitive commodity prices

- Attractive investment risk/reward returns

- Strong transportation systems and good port facilities

- Disease-free reputation

- Implementation of technology innovation

- Well established and understood laws and government

Agriculture plays an important role in the Australian and the world economy. Significant opportunities lie in the ownership of Australian agricultural land and can play a stabilising role in a balanced portfolio over the long-term.

Get in touch with us to learn more about the current investment opportunities in Australia.