Market update – August 2017

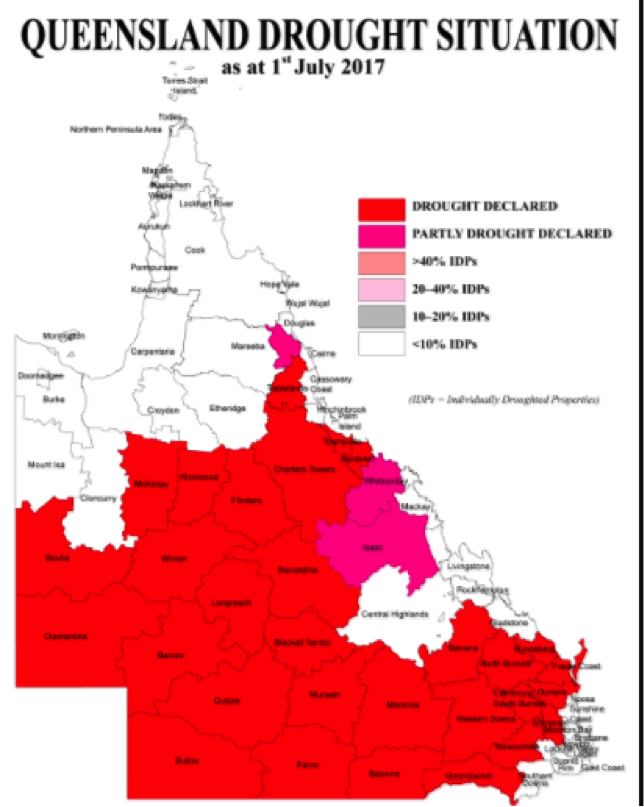

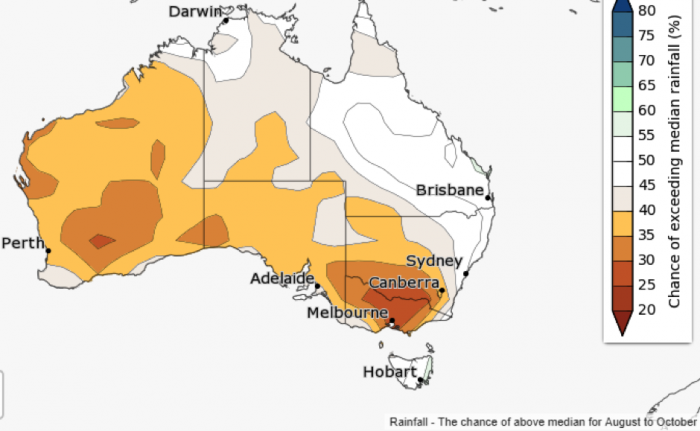

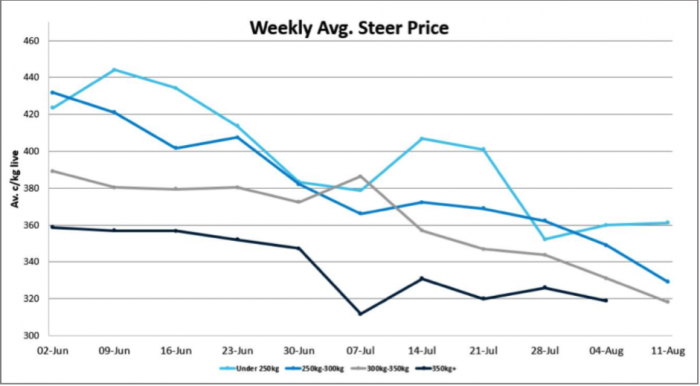

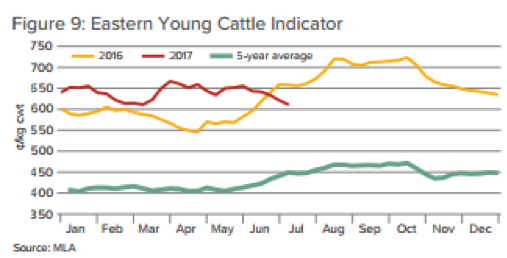

Following on from a dry Autumn and a poor August to October rainfall outlook, the cattle market has continued its downward trend from June highlighting the fact that the cattle price surge is well and truly behind us. Currently, the bottom 60% of QLD is drought declared (see figure 1) and therefore restocker demand has slowed for young cattle, having a major impact on the EYCI (see figure 9).

Figure 1

Many producers that normally hold steers to market as grass-fed bullocks are finding themselves selling these young cattle directly as feeders at around 360-400kg for strong returns a year early. The implications of this early marketing strategy of these cattle are that grass-fed bullocks may be in shorter supply next year and drive higher grid prices.

As the Australian cattle herd continues to build, causing restocking activity to eventually wane and resulting in a more abundant supply of finished cattle, the overall cattle market will struggle to match the trends of recent years. Store cattle right through to the finished end of the market are likely to feel the impact of supply, with store cattle experiencing greater volatility. While this trend is anticipated, continual growth in export demand, combined with reducing tariff schedules, should see the Australian cattle market remain above the existing five-year average for the duration of the projected period.

The first half of 2017 has witnessed a range of shifts in global beef markets: the US continued to challenge Australia’s position in North Asia; quality concerns with Brazilian beef resulted in temporary and indefinite market closures; the Indian government attempted to ban the sale of slaughter buffalo and cattle through livestock markets, and the US regained direct access to China. While the implications of these changes for Australia are not completely clear, the first two have had some material impact on the global trade. Custom cleared beef imports into Korea so far this year are up 12% year-on-year, but Australia’s share of the market has slipped from 53% to 47% on a volume basis – all of which has gone to the US. Likewise, imports into Japan have increased 16% over the same period, but Australia’s share has declined from 56% to 49%.

Find out how Impact Ag can assist in a supply chain management solution for your business.