How are your investments positioned for the rise of the global middle class?

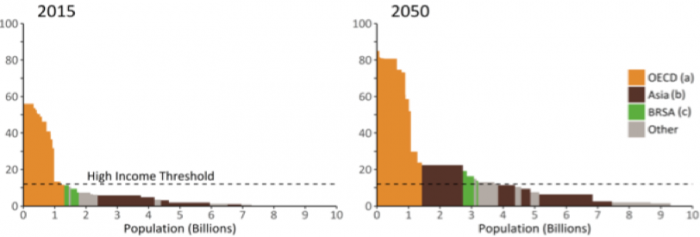

World population is projected to reach 9.8 billion in 2050*, which will continue the dramatic rise in demand for food and fibre currently being experienced. With this population growth comes a rapid expansion of the global middle class, currently 3.2 billion and expanding by 160 million a year#. The recent growth of the middle class has centred on Asia, with this region to provide 88% of the next billion entrants into the middle-class ^.

Some of the trends and themes we are seeing in agriculture include:

- China has some real food security issues moving forward with a lack of water, skilled management and degraded natural resources.

- 20% of US farmland is irrigated producing 40% of the nations production and 50% of the nation’s agricultural value.

There will be 220,000 more people at the dinner table tonight than there was last night.

So what does this mean for Australian agriculture?

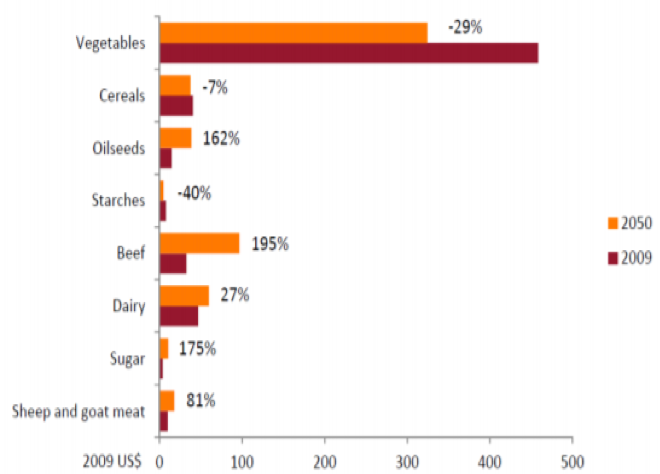

An increase in a middle-class population will not guarantee a rise in demand for all agricultural bulk commodities. The world’s middle-class demand higher value protein, with China projected to decrease consumption of vegetables while consumptions of beef triple out to 2050^.

Australia is well positioned to take advantage of these megatrends and for investors in Australian agriculture, the key is to identify how you can maximise this opportunity. A major opportunity is to be a premium supplier of high-quality product and leverage our competitive advantage. As a nation, we are unable to be the low-cost supplier and therefore need to focus on our value proposition and product differentiation.

Some domestic advantages include:

- Exceptional land value (on a globally developed benchmark+)

- Long-term capital growth

- Clean reputation and outstanding biosecurity

- Robust infrastructure, freight, storage and cold chains

- Proximity to Asia-Pacific markets

- Global leaders in agricultural technology and innovation

- Negligible sovereign risk

- Transparent legal and accounting systems ensure secure land tenure and property rights

- Favourable tax regime, no inheritance tax on agricultural land

Opportunities in China

Recent population growth has centred on Asia. There are more people living inside this circle than outside of it.

The Asian region is set to provide 88% of the next billion entrants into the middle class.

The world’s middle class demand higher value protein, with China projected to decrease consumption of vegetables while consumption of beef triples. This will ensure more produce from fixed resources (land and water).

Private equity participation in Ag is growing. One success story close to home in Australia is the Costa group listing in 2015 which now trades at 25*earnings.

Where should private equity invest to leverage this growth?

Some key areas private equity focus on are:

- High value food

- Businesses that participate in the value chain

- Mid-size businesses that need to scale

- Businesses that supply into Asian markets

- Disruptors within the food sector

- Sector knowledge, validation and timing is critical

- Tangible assets with cash-flow that are stable investments

- Models that are set at 5 or 6 times earnings

- Models that enable the leverage of debt

*UN DESA 2015, 9.8 billion in 2050 and 11.2 billion in 2100

# The Brookings Institution, 2016

^ ABARES 2018

=Land Commodities – Australian Agriculture, via Anson Advisors

Read more…Foreign investment in Australian agriculture.