Exciting steps for Natural Capital

Despite the current, and hopefully short-term, upheaval occurring around the world as a result of COVID19, the urgency required to respond to climate change has not abated. Thankfully, there have been some positive announcements recently from governments and multinationals that will advance the development of natural capital markets and further enable agriculture to be rewarded for being part of the response.

The Australian Government’s recent response to the King Review* into the Emissions Reduction Fund includes several commitments to increase the access and viability of agricultural carbon projects. Another recent announcement, the Agriculture Stewardship Package^, will provide financial incentives to land managers to improve biodiversity. These announcements are supported by State based programs such as Queensland’s Land Restoration Fund+, paying landholders for the ‘co-benefits’ associated with carbon projects such as improving habitat or water runoff.

As well as Government announcements, there has been a flood of announcements globally from businesses committing to carbon neutrality including BP, Microsoft, Rio Tinto, EY and Barclays just to name a few. Many of these businesses are seeking Nature Based Solutions (such as forestry and agriculture) and are willing to incentivise and reward carbon sequestration as well as the related ‘co-benefits’.

*https://www.industry.gov.au/news-media/expert-panel-identifies-opportunities-to-reduce-emissions

^https://www.agriculture.gov.au/about/reporting/budget/sustaining-future-australian-farming

+https://www.qld.gov.au/environment/climate/climate-change/land-restoration-fund

There is an urgent need to address climate change, both in building resilience towards its impacts and being part of the solution.

The King Review

The King Review makes 26 recommendations, all of which have been ‘accepted’ or ‘accepted in principle’ by Government. Eight of these recommendations relate broadly or specifically to agriculture, two key items include:

- In the near term, subsidising the cost of soil carbon measurement to alleviate one of the biggest barriers to participation, subsequently unlocking one of the greatest potential pools of sequestration.

- In the medium term, enabling third parties to apply new technologies (via proposed method amendments) to reduce measurement and transaction costs.

Ultimately, more viable agricultural carbon projects lead to more carbon abatement, increased productivity, improved financial returns and greater climate resilience across the agricultural sector.

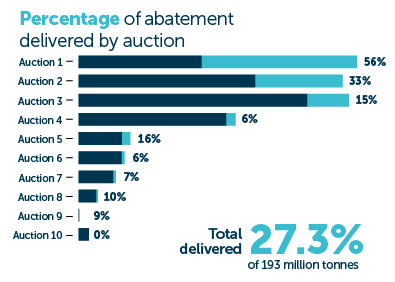

Percentage of abatement delivered by auction and across all auctions. Source: Clean Energy Regulator

Opportunities for Agriculture

We believe building natural capital for future generations can be done profitably. There is an urgent need to address climate change, both in building resilience towards its impacts and being part of the solution. Natural capital markets that incentivise and reward good land management, we believe, have a huge role in establishing a sustainable, equitable, agricultural sector.

We are actively pursuing a range of regulatory and private natural capital markets for assets under our management, as well as advisory clients. If you’d like a tailored assessment of current and near term opportunities in this space, please contact us.