2016 Red Meat in Review

2016 will be a year to remember for the beef and lamb industries within Australia. The cattle industry has been through a year of huge price increases as the demand for feedlot and restocker cattle has fuelled the market to record highs, whilst the national herd is at a 20 year low.

The Australian sheep and lamb markets have benefitted from reduced supplies and resilient support from domestic consumers. Whilst exporters have expressed mixed signals around demand, 2016 could be the fourth consecutive year of higher year on year prices.

With 2016 nearly behind us, what are the emerging consumer trends domestically and internationally around red meat consumption?

Domestically we love our meat and eat about 3 times the amount of the global average. According to the OECD Australian’s consume close to 93kg per annum per person and the global average is around 30kg.

Australian consumers continue to enjoy meat with 48% of total $ value in the standard shopping basket in meat products.

Major trends are generally first witnessed in the food service sector and then flow into the retail chains. Consumer awareness of providence, animal welfare and environmental impact are continuing to build. Natural and grass-fed brands continue to strengthen over the past few years whilst the consumer and value chain are still trying to understand its definition and the strength of validation.

A trend we are seeing globally in the fast food industry is the use of meats that have providence and production verification such as free range and natural, primarily this trend started in the northern hemisphere in the Mexican food industry and burger markets. The more up market outlets are now using cuts not typically used in grinding meat and even grinding meat on site in preparation for burgers.

Consumers are moving towards alternative meat offerings that have lower price points but still have perceived value. Evidence of this is the growing demand for those secondary cuts used in barbeques such as ribs, briskets and flat irons and the use of slow cooking techniques utilising these cuts at home.

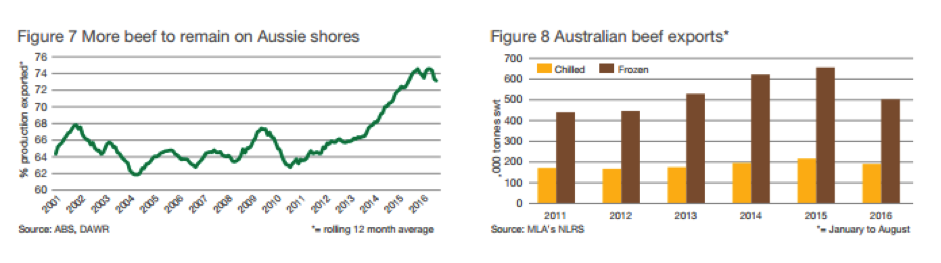

Interestingly, and encouragingly for Australian beef producers, the decline in chilled beef exports (or higher valued product) this year has been less than frozen beef to each of the largest markets. In fact, chilled volumes for the year-to-date are down 12% year-on-year, while frozen is down 23%.

Globally Australia is forging a reputation as a supplier of more premium quality beef. The export beef market whilst under extreme price pressure has been able to keep the average unit price around $6.96/kg, 4% down on the 2015 October quarter. This is due to the fact our exports of chilled product as a percentage of the total have risen 2% to 27%.+

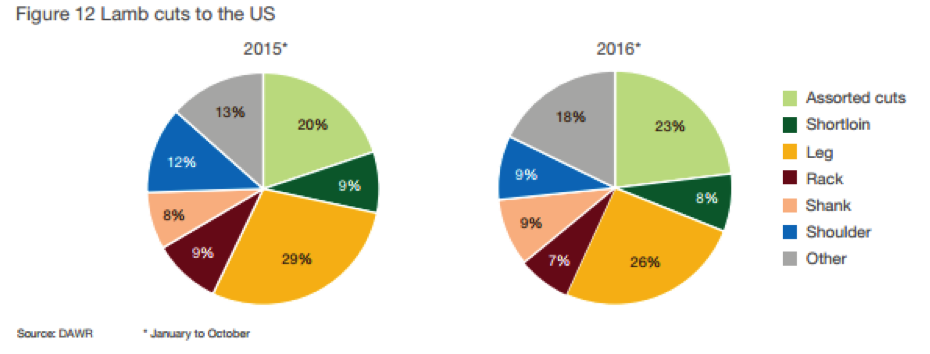

Lamb shipments to our largest market the US, have already increased by 8% for the January-October period but new trends are emerging amongst lamb consumption. Traditional exported cuts such as shoulders, legs and racks are not the growth areas.

The cuts underpinning the overall growth in exports for the year so far are assorted cuts (three or more primals packed together), which increased 25% from year-ago levels to 9,904 tonnes swt, along with shank (up 25%, to 3,991 tonnes swt),

Bert Glover