Why are a growing number of UK/EU investors landing on Australian shores?

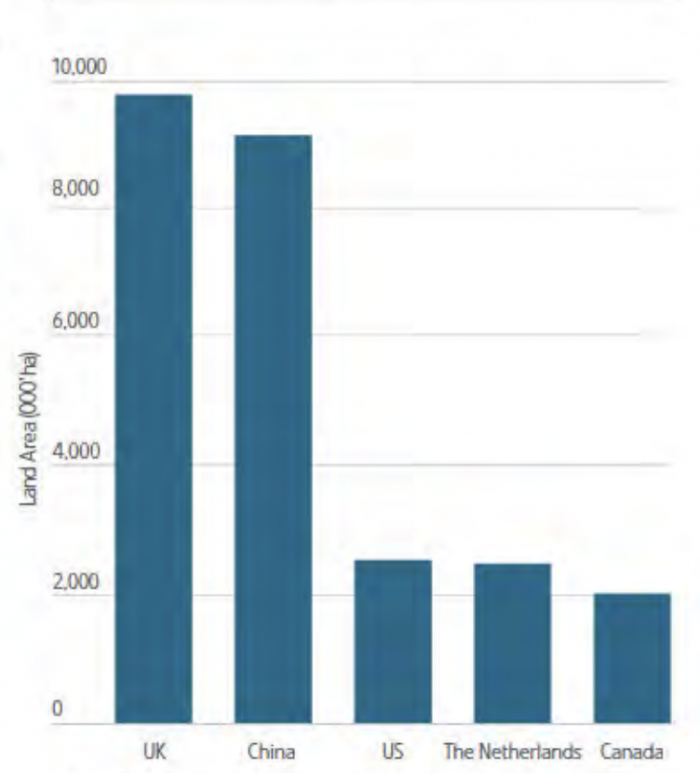

Recent years have seen more foreign investors looking to capitalise on Australia’s existing sector strengths. UK investors have already established a significant presence in Australia’s agribusiness sector and remain the largest foreign holder of Australian agricultural land.

Foreign-held portion of Australian agricultural land (as at 30 June 2017) Source: ATO, Register of Foreign Ownership of Agricultural Land 2017

So why are more UK investors investing in Australian agriculture?

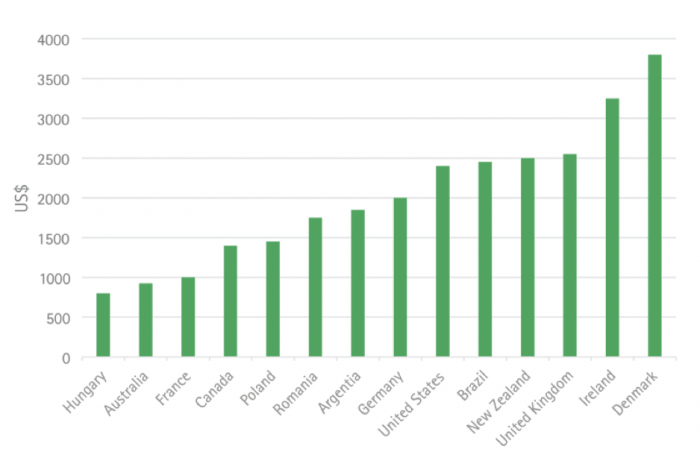

Globally, Australian agricultural land presents significant value. Australian farm assets remain comparatively inexpensive compared to other international markets.

The average Australian rural land price (based on a unit of production) is US$950 per tonne of annual wheat produced (Anson Advisory). This is less than half that of major export competing nations such as:

- United Kingdom US$2,575 / tonne annual wheat

- New Zealand US$2,500 / tonne annual wheat

- United States US$2,400 / tonne annual wheat

- Brazil US$2,400 / tonne annual wheat.

Source: Land Commodities – Australian Agriculture, via Anson Advisory

There are a growing number of UK/EUR investors landing on Aust shores, why have they invested?

Returns

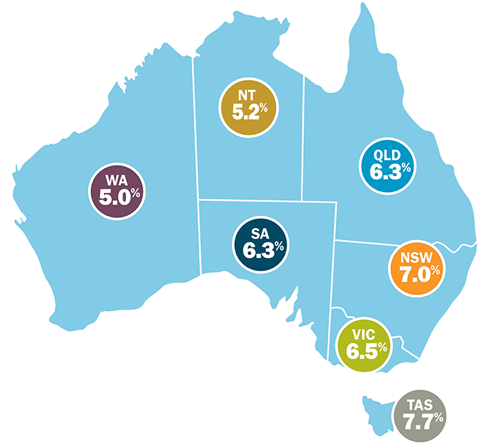

Over the past 20 years, Australian farmland values have achieved an average annual capital return of 6.6% (Rural Bank, 2018) with a forecast for strong capital growth to continue (Rabobank, 2018). Comparatively, the UK market peaked in 2014 and has since declined with a flat outlook forecast into the mid-2020s (Savilles, 2018).

Australia’s average farm operating profit for the period 2013-2017 was just under seven times larger than a decade earlier (2003-2007)(Rabobank, 2018). This profit has primarily come from broad-acres cropping and mixed livestock farms and has been driven by domestic efficiencies and macro-economic conditions.

Source: Rural Bank 2018

Size of the Sector

While the UK agricultural sector shares in some of the same macro opportunities being offered to Australian agriculture, the size of the market restricts investment opportunity. In 2017, an estimated 235 farms were marketed for sale across the UK, totally approximately 85,000 acres with an average size <500 acres (Strutt & Parker, 2018). In NSW alone in 2017, over 5.4 million acres of farmland was traded in 3,740 transactions for a value of £2.1 billion. Australia’s sheep flock is around 75 million, the beef herd 29 million and on average over 50 million acres are sown to cereal and pulses each year (ABARES, 2018).

Investment Trends

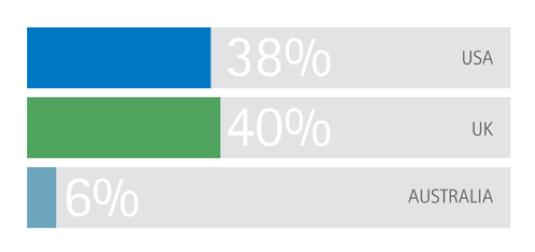

Despite Australia’s agricultural industry being one of the most advanced and efficient in the world (with little to no government subsidies), the sector has traditionally lagged behind global investing trends. Leasing of farm land in Australia is under-utilised when compared to England and the USA (RIRDC). This presents an opportunity as the Australia market starts to adopt this trend as more international investors enter the market and as domestic operators start to mature and position their businesses to attract and partner with these investors.

Farmland Leasing Rates Source: Land Commodities – Australian Agriculture, via Anson Advisors

Brexit – what are the implications for a UK investor globally and why Aust investment will make sense?

While the future of UK and USA access to traditional markets might be under a bit of a cloud, Australia’s proximity to the Asia-Pacific, regional free trade agreements and its growing reputation as a clean green producer of food and fibre provides access to the largest and fastest growing market in the world.

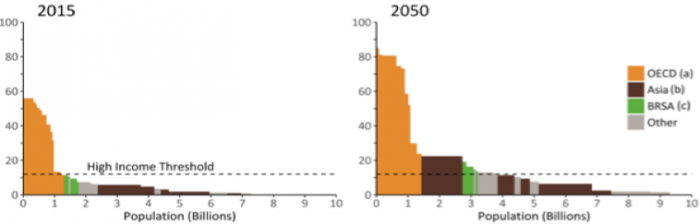

Recent population growth has centred on Asia with this region to provide 88% of the next billion entrants into the middle class (ABARES 2018).

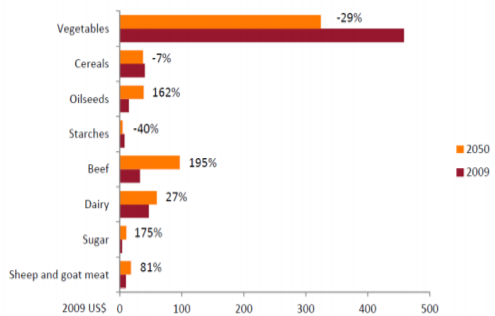

The world’s middle class demand higher value protein. China is projected to decrease consumption of vegetables for increased consumption of meat, dairy and sugar products, all key Australian agricultural exports (ABARES 2018). Australia’s beef exports to China are up 48% year to date.

In addition to the above, Australia agriculture also benefits from the following:

- Global leaders in agricultural technology and innovation

- Negligible sovereign risk, stable government structure

- Transparent legal and accounting systems ensure secure land tenure and property rights

- Favourable tax regime, no inheritance tax on agricultural land

Optimism for agricultural commodity prices – increase trade opportunities for Aust?

Most of Australia’s major agricultural commodities are experiencing above average to near record high prices due to several macro-economic drivers such as supply, market demand, market access, foreign exchange rates and quality of produce. ABARES reports the value of farm production is forecast to be £34 billion in 2018-2019, 11% above the 10-year average. Lamb and wool prices are at or near to record highs due to export market demand with China in recent years becoming an established market for wool. Beef and veal remain above the 10-year average price despite some herd liquidation due to climatic conditions. A reduction in crop production this year is somewhat being offset by above average commodity prices.

Get in touch with us to learn more about the current opportunities in Australia or view our current Australian Investment Opportunities.