Market snap shot – October ’16

As we move toward the end of November and the 2016 year, we have spent a little time reflecting on what has been a remarkable calendar year for cattle prices, beef producers and the Australian beef industry in general.

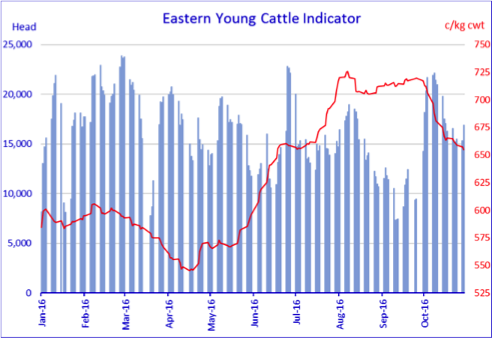

The Eastern Young Cattle Indicator (EYCI) began the year at 585c/kg and after moving sideways during the March quarter dropped 7% to a year low of 545c/kg during the final week of April on the back of continuing and prolonged drought conditions across the eastern states of Australia.

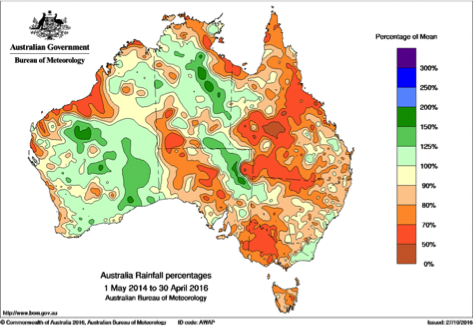

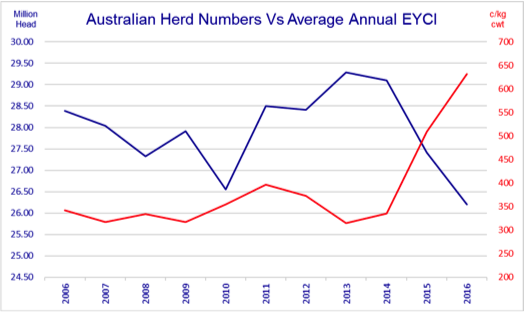

Bureau of Meteorology rainfall charts details a prolonged period of below average rainfall for the entire eastern portion of Australia from mid-2014 to mid-2016 with seasonal averages some 25% – 95% below normal. These prolonged drought conditions, combined with record high prices for Australian cattle, have contributed to a steady liquidation of the Australian cattle herd over the past two years.

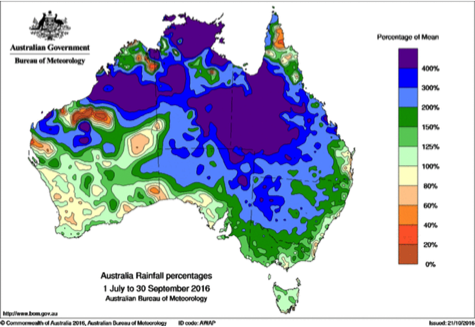

Unseasonal winter and early spring rainfall across much of central and eastern Australia resulted in excellent winter pasture growth and an unprecedented increase in demand for cattle from producers seeking to restock land previously destocked during the drought. Much of Qld and NSW recorded rainfall of 25% – 400% above seasonal averages during this period and, as a result, the EYCI rose 33% over the four months from a late April low of 545c/kg to a mid-August high of 726c/kg on the back of strong demand and limited cattle supplies.

Since its August peak, the EYCI traded sideways with September prices trading in a tight band to average 712c/kg as wet weather limited access to already tight supplies of cattle, resulting in strong competition between restockers, feedlots and meat processors.

Given the excellent growing season for grass, cattle purchased by restockers make up the largest proportion of stock purchases in 2016 within the EYCI buyer breakdown below. Processors particularly have slaughtered fewer numbers as prices for cattle have risen and prices for beef globally have fallen. The feedlot sector has also been impacted by higher cattle prices, however, has welcomed lower grain pricing which has contributed to maintaining stock numbers on feed.

What does this mean for producers? Read more here